US inflation shows signs of easing

KUWAIT: In his remarks at the International Journal of Central Banking Conference 2024, Governor Christopher J Waller addressed the current economic challenges, particularly high inflation which is currently at 3.3 percent y/y, and post-pandemic structural changes.

He highlighted the significant fiscal responses required to navigate these issues and the critical role of monetary policy in stabilizing the economy. Waller stressed the importance of economic data in guiding effective policy decisions during these uncertain times. The speech comes following the June FOMC meeting, where members revised down their anticipation of three rate cuts in 2024 down to one cut.

US consumer confidence

US consumer confidence fell to 100.4 in June, down from 101.3. The figure was slightly above expectations of 100.0 for the month. Increases were seen in the present situation index, which rose to 141.5 up from 140.8. While the expectations index fell to 73.0, down from 74.9 in May, marking the fifth month of a figure below 80 for the sub-index. In a speech following the release, Dana M. Peterson, Chief Economist at the Conference Board, expressed that “confidence pulled back in June but remained within the same narrow range that’s held throughout the past two years, as strength in current labor market views continued to outweigh concerns about the future”.

US new home sales

New home sales in the US plunged to the lowest level in six months, coming in at 619,000 from 698,000 previously and below the expected 636,000 figure. Elevated interest rates and the expectation that it will remain higher for longer, is weighing in on homebuilders. Despite this, US housing prices rose for the eleventh consecutive month in May to $419,300, mostly due to supply constraints that have been an issue for decades.

This scenario creates a headache for the Fed, with high interest rates cooling demand for new houses yet prices continue to rise and contribute to inflationary pressures. Fed Chair Jerome Powell stated that in terms of housing, he expects the declining pace of increase in rents to eventually reflect itself in future inflation readings.

The US economy grew at a modest 1.4 percent annual rate in the first quarter of 2024, marking a significant slowdown from the robust 3.4 percent growth observed in the final three months of 2023. This deceleration was primarily driven by a surge in imports and a drawdown in business inventories, which can be volatile and may not necessarily reflect the underlying strength of the economy.

Consumer spending, a key driver of economic growth, also exhibited a notable slowdown, expanding at a 1.5 percent rate compared to a previously estimated 2 percent. This moderation could potentially be attributed to the recent rise in interest rates. However, a bright spot emerged in the form of business investment, which rose at a healthy 4.4 percent annual pace. This increase was fueled by investments in factories, software, and other forms of intellectual property, suggesting confidence among businesses and potentially boding well for future economic activity.

US unemployment claims

The number of new unemployment claims in the US decreased last week, falling by 6,000 to 233,000 for the week ending June 22nd. However, despite this decline, the overall number of people receiving unemployment benefits rose for the eighth straight week, reaching 1.84 million for the week of June 15th. This represents the highest level since November 2021.

US PCE price index

Inflation in the United States showed signs of further easing in May 2024, with the personal consumption expenditure (PCE) price index remaining unchanged from April. This marks the slowest inflation rate in six months and aligns with forecasts following a 0.3 percent increase in April. The core PCE index, which excludes food and energy prices, also moderated to its lowest level since November 2023, rising just 0.1 percent. This trend of easing inflation is reflected in the annual PCE rate and core PCE inflation both falling to 2.6 percent, representing the lowest level in over two years.

Canada CPI

Consumer prices in Canada rose unexpectedly in May, accelerating to 2.9 percent annually from 2.7 percent previously and above the expected 2.6 percent figure. Additionally, measures of core inflation also edged higher for the first time in five months, causing markets to trim down hopes of a July rate cut to below 50 percent. The Bank of Canada delivered a 25-basis points rate cut earlier in the month to take the overnight rate down to 4.75 percent.

Officials from the central bank maintained that they will remain data dependent regarding any future monetary policy action, and the latest inflation reading is not what they wanted to see. The surprise rise in inflation was driven mainly by prices in the services sector, including air transportation, cellular services, and rent. Additionally, grocery prices accelerated for the first time in a year while energy inflation slowed down. Overall, services prices increased to 4.6 percent from 4.2 percent previously, while goods inflation was steady at 1 percent. The US Dollar index closed the week at 105.87.

UK final GDP q/q

The British economy grew at a stronger than anticipated pace of 0.7 percent in the first quarter of 2024, marking the end of the recession and representing the strongest expansion in over two years. This growth was driven by a rise in services (0.8 percent), particularly scientific research, development, legal activities, and household spending (0.4 percent), fueled by expenditures on recreation, culture, housing, and food. Despite initial higher estimates, growth in the production sector (0.6 percent) was dampened by a downward revision in manufacturing output. Construction also saw a decline of 0.6 percent. Overall, year-on-year growth came in at 0.3 percent, exceeding the initial estimate of 0.2 percent. The GBP/USD currency pair closed the week at 1.2642.

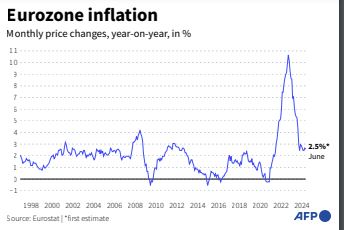

Eurozone inflation

In June 2024, several European countries reported changes in their inflation rates. France experienced a welcome slowdown in inflation, with the annual rate dipping to 2.1 percent, the lowest level since August 2021. This decrease was attributed to lower prices for food and energy. Spain also saw a slight moderation in inflation, edging down to 3.4 percent after a three-month uptrend. In contrast, Italy’s inflation rate remained unchanged at 0.8 percent. These mixed results suggest that inflationary pressures may be starting to ease in some parts of Europe. The EUR/USD currency pair closed the week at 1.0713.

Inflation in Australia

Australia’s inflation rate keeps surging past predictions, reaching a three-month high in May. This surge caused the Australian dollar to rise in value as investors anticipated the Reserve Bank of Australia (RBA) raising interest rates again soon. According to government data released on Wednesday, the consumer price index (CPI) increased by 4 percent compared to the previous year, exceeding economist expectations of 3.8 percent. Meanwhile, CoreCPI, which excludes volatile items to provide a more stable inflation picture, also rose to 4.4 percent from 4.1 percent in April.

Tokyo core CPI y/y

Japan’s core inflation in Tokyo rose to 2.1 percent year-on-year in June, exceeding expectations and signaling intensifying inflationary pressures. This increase comes alongside a significant boost in industrial production in May, which surged by 2.8 percent month-on-month, fueled by rising auto production. However, the Ministry of Economy, Trade and Industry remains cautious. While acknowledging improvement in private sector sentiment and the uptick in auto production, the ministry maintained its previous assessment that industrial output remains indecisive and lacks a clear trend.

The USD/JPY currency pair closed the week at 160.83, while the AUD/USD currency pair closed the week at 0.6667.

Kuwait

Kuwaiti dinar

USD/KWD closed last week at 0.30665.