US inflation eased in October for the first time in months - Report

WASHINGTON, Nov 14 (KUNA) -- The US Bureau of Labor Statistics said on Tuesday that inflation eased in October for the first time in months, providing some welcome relief to American consumers who have been crushed by unrelenting price increases.

US Labor Department said that the consumer price index, a broad measure of the price of everyday goods including gasoline, groceries and rent, was unchanged in October from the previous month.

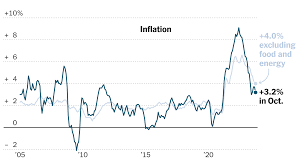

Prices climbed 3.2 percent from the same time last year.

Other parts of the report pointed to cooling price pressures within the economy.

Core prices, which exclude the more volatile measurements of food and energy, climbed 0.2 percent, or 4 percent annually.

Both of those figures are lower than Refinitiv economists expected.

Still, the report indicates that while inflation has fallen considerably from a peak of 9.1 percent, it remains well above the Federal Reserve's 2 percent target.

Consumers continued to see some reprieve in October.

The price of gasoline plunged 5 percent last month and is down 5.3 percent from the same time last year.

Other price gains proved persistent and stubbornly high in October. Shelter costs, which was the largest contributor to core inflation last month, rose 0.3 percent on a monthly basis and are up 6.7 percent over the past year.

High inflation has created severe financial pressures for most US households, which are forced to pay more for everyday necessities like food and rent.

The burden is disproportionately borne by low-income Americans, whose already-stretched paychecks are heavily affected by price fluctuations.

The Federal Reserve has signaled it is closely watching the report for evidence inflation is finally subsiding as policymakers try to cool the economy with a series of interest rate hikes.

Officials approved 11 rate increases in a span of just 16 months, lifting the benchmark federal funds rate from nearly zero to the highest level since 2001.

The cooler-than-expected data has solidified many economists' expectations that the Fed is done hiking interest rates. (end) rsr.mb.