Shadow economy thrives in the presence of an illegal labor force

KUWAIT: In today’s global economy, the presence of “black money” and the informal economy cannot be ignored. The existence of unreported or unregistered activities, both legal and illegal, creates a shadow economy that operates outside the boundaries of official regulations.

Salman Al-Naqi.

The motivations behind this phenomenon vary, from tax evasion to the desire to bypass complex regulations. However, in Kuwait, where taxation is absent, the shadow economy thrives on the presence of a shadow labor force and illegal immigrants.

The consequences of this informal economy can be far-reaching, affecting the state’s gross domestic product (GDP), state revenues and even its reputation. Kuwait Times spoke to Salman Al-Naqi, a Kuwaiti PhD candidate in economics. He won the “Kuwait Economic Student Award” from the Central Bank of Kuwait in 2023 and is the research paper winner of the “Kuwait Economic Prize” in 2022.

Naqi explained to Kuwait Times the definition of the informal economy and its different terms and types of activities. “The phenomenon of black money is generated by sectors of the informal economy. Informal, shadow or underground economy - all these terms refer to activities or businesses that are either unreported or unregistered under the official economy. The taxonomy of the informal economy is of two types — legal activities that result in unreported income or work; and illegal activities such as trade in stolen goods, drug dealing, fraud and money laundering. Meanwhile, transactions within the informal economy sectors take either a monetary form, such as cash, or non-monetary form, such as bartering,” he explained.

Naqi further elaborated on the factors driving the shadow economy and explained how it exists despite the absence of taxation in countries like Kuwait. “The existence of the shadow economy is driven by several factors. Broadly speaking, tax evasion or avoidance is often the main reason for the prevalence of informal economic activities. However, in the context of Kuwait, where taxation is entirely absent, the shadow labor force becomes a critical driving force behind the informal economy. The existence of this type of labor force can be attributed to individuals working second jobs or to illegal immigrants participating outside the official framework,” he said.

“Furthermore, the tendency to bypass complex regulations and rapidly changing restrictions in the business environment contributes to the acceleration of shadow activities. Weak and inefficient institutions contribute to an increase in these practices. Some individuals engage in the shadow labor market to retain their social welfare benefits, while others aim to evade the financial burdens imposed by the government or engage in money laundering activities,” he added.

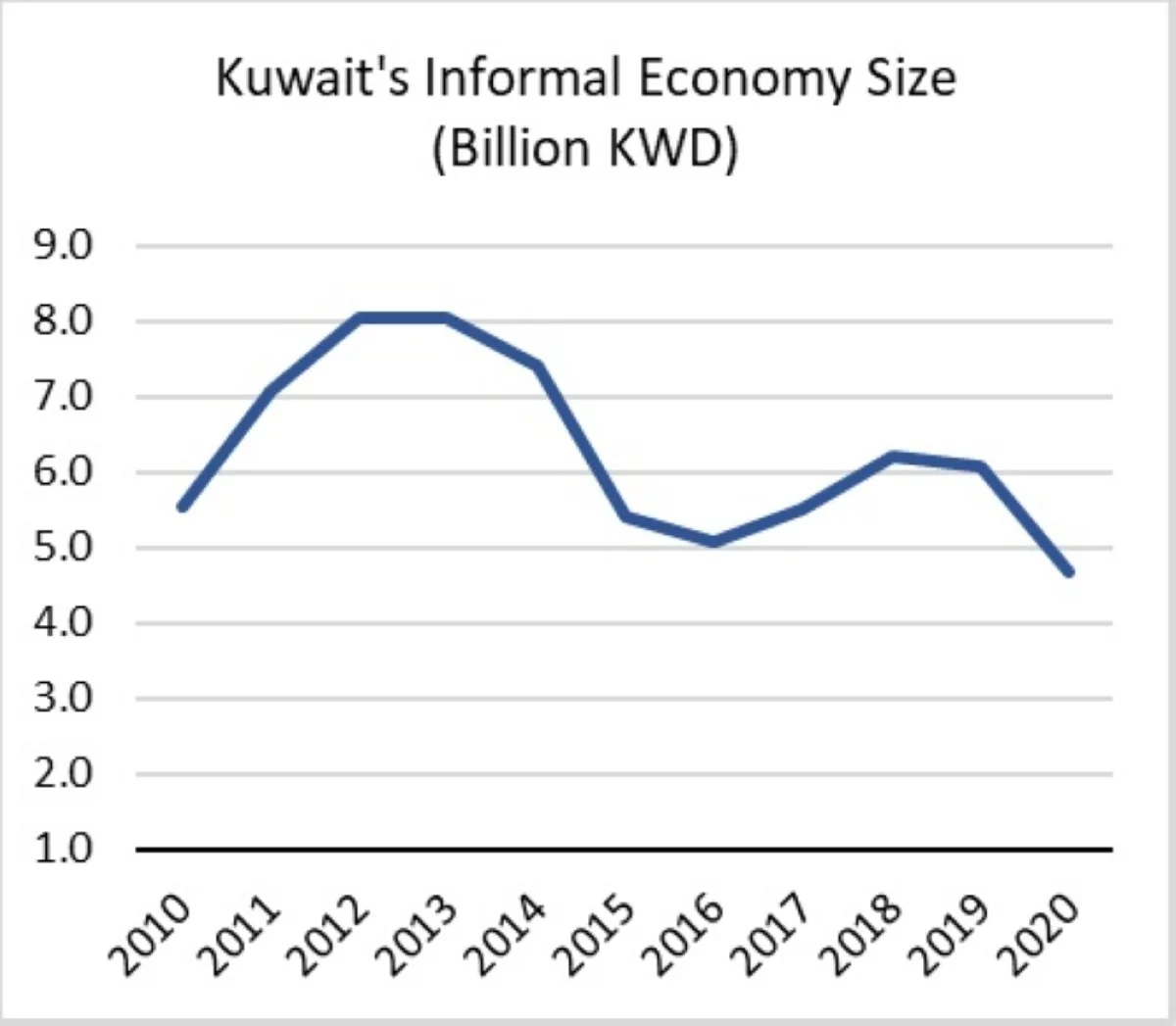

Naqi referred to World Bank statistics to address informal money in Kuwait. “According to recent statistics from the World Bank, the average relative size of the informal economy in Kuwait over the past 10 years is 16 percent of total GDP. This figure implies that billions of Kuwaiti dinars are not officially accounted for or observed within the official GDP index. These losses are not only statistical, but reduce state revenues and hinder any future steps to impose taxes. Additionally, the sectors of the shadow economy carry implicit costs for the state, as they introduce misleading indicators about the domestic size of the output and market. In turn, this affects the decisions of policymakers and investors in terms of assessing the actual status of the economy. Likewise, the expansion of unregulated and unreported activities increases criminal activity levels and exhibits signs of explicit corruption,” he pointed out.

Naqi emphasized on addressing the informal economy. “Addressing the informal economy requires numerous procedures. Firstly, measuring the extent of shadow activities can be achieved by expanding statistical surveys and financial auditing, identifying discrepancies between national expenditure and income and examining money demand. In the same vein, formalizing unregulated businesses and promoting cashless payment methods are critical factors in tracing unreported income or activities. This should be done in line with efforts to increase financial and social inclusion of broader segments of people,” he advised.