Private equity investing

KUWAIT: Private Equity (PE) is an illiquid alternative asset class that involves investing in privately held companies.

When investors pool their capital into a fund, the goal is to enhance the companies’ value and realize profits when exiting investments. This can be achieved through methods like initial public offerings (IPOs) or mergers and acquisitions (M&A).

The funds are managed by PE firms that structure them as Limited Partnerships, with General Partners raising capital from Limited Partners. Private equity investments are illiquid and require several years before yielding positive returns, following what is known as the J-curve effect.

Private equity firms are actively engaged in acquiring companies, improving their performance, and delivering returns to investors. They use various strategies such as buyouts, venture capital, and growth equity to target companies at different development stages. Through close collaboration with management teams, these firms implement initiatives to enhance the value of the invested companies over time, distinguishing private equity from other investment vehicles and positively impacting job creation and economic growth.

The industry has evolved significantly, attracting a wider range of investors seeking diversification and market opportunities. The combination of smart acquisitions and liquid credit markets fueled private equity successes in the early 2000s. Following the Global Financial Crisis (GFC), the recovery of private equity funds was swift, solidifying the industry as a popular choice among investors.

Private equity investments are critical in injecting capital into private companies or converting public entities into private entities. Primary investments involve capital infusion at various development stages, while secondary investments entail purchasing existing stakes in private equity funds. Co-investments allow investors to participate alongside private equity firms in specific deals, providing lower fees and greater control over investment decisions.

Private equity fee structures include management fees, calculated as a percentage of committed capital, and performance fees, aligning LPs and GPs interests by sharing profits after achieving specific return levels. Investors should assess their risk tolerance, financial obligations, and expected returns before investing in PE funds.

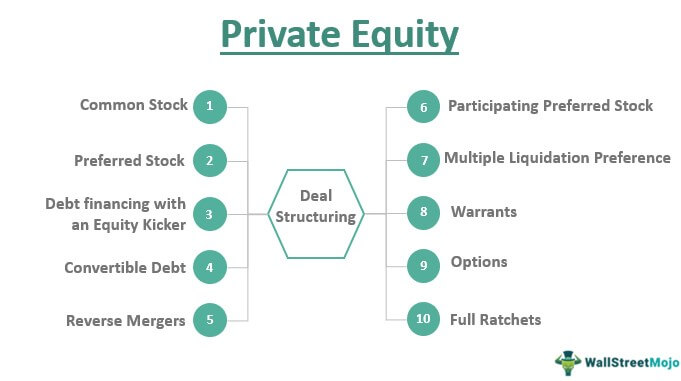

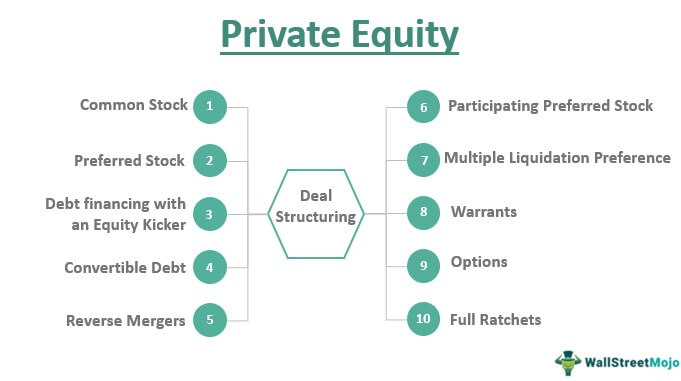

Private equity investments typically aim to provide higher risk-adjusted returns but require a long-term (10-15 years) commitment due to the illiquid nature of the investments, thus investors in PE funds typically expect potential higher enhanced returns or “illiquidity premium”, to compensate for the risk profile, illiquidity, and long duration of such investments. There are various private equity strategies, such as venture capital, growth capital, leveraged buyouts, and distressed funds, each targeting companies at different lifecycle stages.

Private equity performance is evaluated using metrics like Internal Rate of Return (IRR) and investment multiples to measure the fund’s success. The Net Asset Value (NAV) plays a crucial role in valuing private equity funds, as they are not publicly traded, relying on estimates made by general partners. Private equity investments offer attractive returns, create long-term value, and contribute to portfolio diversification. They demonstrate resilience against market cycles, with historical data showing positive performance over the years. By including private equity in a diversified portfolio, investors can potentially enhance returns and reduce risk. Ultimately, private equity presents opportunities for investors to participate in the transformative journey of companies across various industries and sectors.

Private equity involves investing in private companies to enhance their value and realize profits.

It is managed by firms as limited partnerships, utilizing strategies such as buyouts and venture capital. Before committing to illiquid PE investments, investors should assess their risk tolerance and expected returns.

The performance of PE investments is evaluated using metrics like Internal Rate of Return (IRR) and investment multiples.

l PE offers attractive returns, long-term value creation, and diversification benefits.

l The evolving industry attracts diverse investors seeking market opportunities.

l Net Asset Value (NAV) is crucial for valuing PE funds due to the lack of public trading.

l PE investments display consistent positive performance and are resilient to market cycles.