Oil prices fall amid demand concerns; OPEC+ to unwind supply cuts from Q4

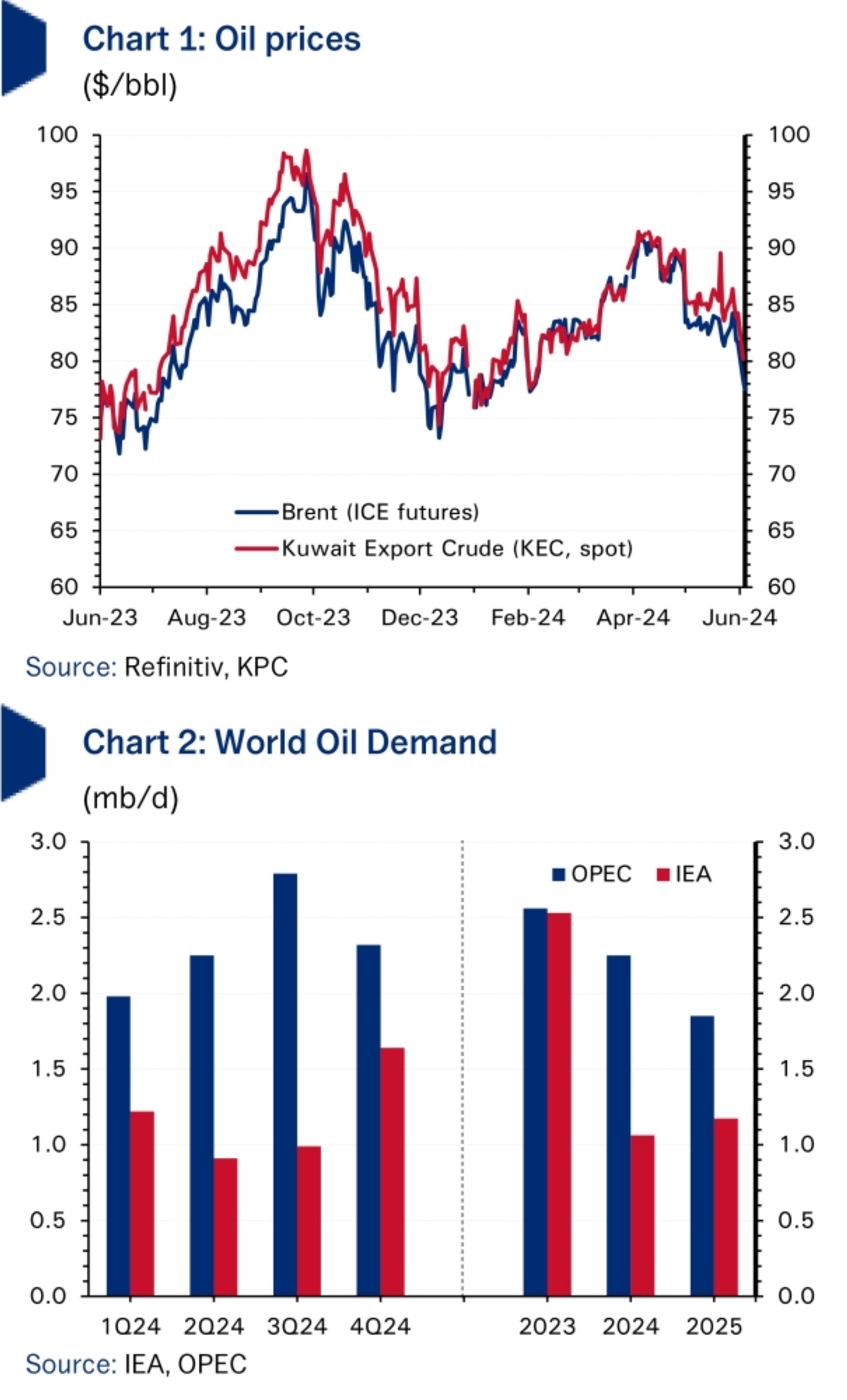

KUWAIT: Oil markets sold off heavily in May amid easing geopolitical risk premiums and intensifying concerns about the impact on oil demand of higher-for-longer interest rates. Brent futures closed the month down 7.1 percent m/m at $81.6/bbl (+5.9 percent ytd).

The positive spread between the front month and third month contract, a structure known as backwardation (prices for prompt delivery being higher than prices for delivery in the future), narrowed to a multi-month-low of just $0.28/bbl as May drew to a close, a sign of more ample near-term supplies and a looser market. Meanwhile, local market Kuwait Export Crude (KEC) ended the month at $83.9/bbl (-5.5 percent m/m; +5.5 percent ytd).

Moving into early June, Brent dropped below $80, weighed down by an increasingly bearish interpretation of OPEC+’s decision at the 2 June ministerial meeting to begin unwinding the 2.2 mb/d of voluntary supply cuts (announced in November 2023) from October this year. The announcement took the market by surprise as the consensus was that with the price of Brent ranging in the low 80s amid concerns of potential oversupply OPEC+ would likely roll over their production cuts through to the end of the year.

The eight OPEC+ members taking part in 2024’s additional voluntary cuts including Kuwait (-135 kb/d), Saudi (-1,000 kb/d), the UAE (-163 kb/d) and Oman (-42 kb/d) will begin re-supplying the market over a period of twelve months ending September 2025. Existing group-wide production cuts from November 2022 and voluntary cuts from April 2023 totaling around 3.60 mb/d were extended through to the end of 2025.

Moreover, the UAE secured another quota increase, this time of 300 kb/d, to add to the 200 kb/d it negotiated for 2024, arguing successfully that its output should be higher to reflect its increased production capacity. This increase will take effect gradually starting January 2025, with the full 300 kb/d output gain reflected in September of that year. For the rest of the group, the deadline for capacity assessments to determine baseline production levels by the three independent agencies has been pushed back by almost a year to November 2025.

Oil demand growth estimates for 2024 and 2025 by energy forecasting agencies the International Energy Agency (IEA) and OPEC continue to show wide variation. OPEC, with its forecast that oil demand would grow by 2.25 mb/d this year to 104.5 mb/d and by 1.85 mb/d to 106.3 mb/d in 2025 is the outlier by far in relation to consensus forecasts.

The IEA, in contrast, sees demand growing by a downwardly revised 1.1 mb/d (-140 kb/d) in 2024—the second downgrade in a row—amid continued weakness in OECD consumption and especially in Europe, where gasoil/diesel consumption has been hard hit by weak industrial activity and rising EV use. For 2025, the IEA sees oil demand growth accelerating slightly to 1.2 mb/d, driven by non-OECD growth.

On the supply side, OPEC+ production (quota members only) fell by 250 kb/d in April to 34.2 mb/d, according to OPEC secondary source data. The decline was led by Russia, which reduced output by 154 kb/d to 9.3 mb/d, in line with plans outlined in March to switch from basing its voluntary supply cuts on exports to production during Q2.

Serial overproducers Kazakhstan and Iraq also reduced output, by 50 kb/d and 31 kb/d, respectively, but the cuts were only small and both producers continue to pump above their quotas—Iraq by 181 kb/d. Indeed, both producers attended a workshop in May with the OPEC secretariat to thrash out a plan of compensatory production cuts to be implemented and concluded by year-end. For Iraq, which overproduced by as much as 602 kb/d cumulative up to the end of March, the plan would see monthly compensatory cuts (output reduced below quota) starting at 50 kb/d in May and ending at 152 kb/d in December.

Among OPEC’s quota-exempt members, Iran’s production hit a new post-Trump sanctions high of 3.2 mb/d in April. Furthermore, amid fresh US sanctions targeting the country’s exports, the country plans to increase production capacity to 4.0 mb/d from the current 3.6 mb/d, though Iran’s official press agency was opaque about a timeframe.

In the US, crude production continued to range at near record levels of 13.1 mb/d, just a little below the US Energy Information Administration’s (EIA) forecast of 13.2 mb/d (avg.) for this year. For 2025, the EIA expects output to increase by a further 500 kb/d to 13.7 mb/d, though this figure could be ambitious given expectations of a likely slowdown in oil investment from US firms amid high labor and equipment costs. Oil rig counts, an indicator of future output, dropped to 496 by the end of May, down 10.6 percent y/y, according to Baker Hughes.

Oil market fundamentals should continue to point to stock drawdowns in 2024, though after the OPEC+ decision to begin restoring withheld voluntary supply to the market from Q4 onwards, balances should start to loosen. The IEA sees the ‘call’ on OPEC+ crude (the volume of OPEC+ oil required to balance the market factoring in demand and non-OPEC supply) at around 42 mb/d in the second half of the year, more than 900 kb/d higher than aggregate OPEC+ production in April.

Even with volumes returning in Q4, OPEC+ will still be significantly underproducing given this arithmetic. That said, OPEC+ looks to have expressed its intention to the markets (and for US shale companies, too) that, for the next year and a half, supplies will be returning. The pace will be gradual and subject to constant OPEC+ reassessment of market conditions; a pause or reversal in production policy remains a strong possibility. But the onus will increasingly fall on oil demand growth to perform well to help keep prices within ranges acceptable to the oil producers.