Kuwait’s upstream sector sees room for growth amid sweeping changes

KUWAIT: Kuwait’s dissolution of parliament on May 10 and the suspension of a few constitutional articles will likely augur a new era of positive business sentiment, particularly for the OPEC producer’s stagnant upstream sector, analysts said.

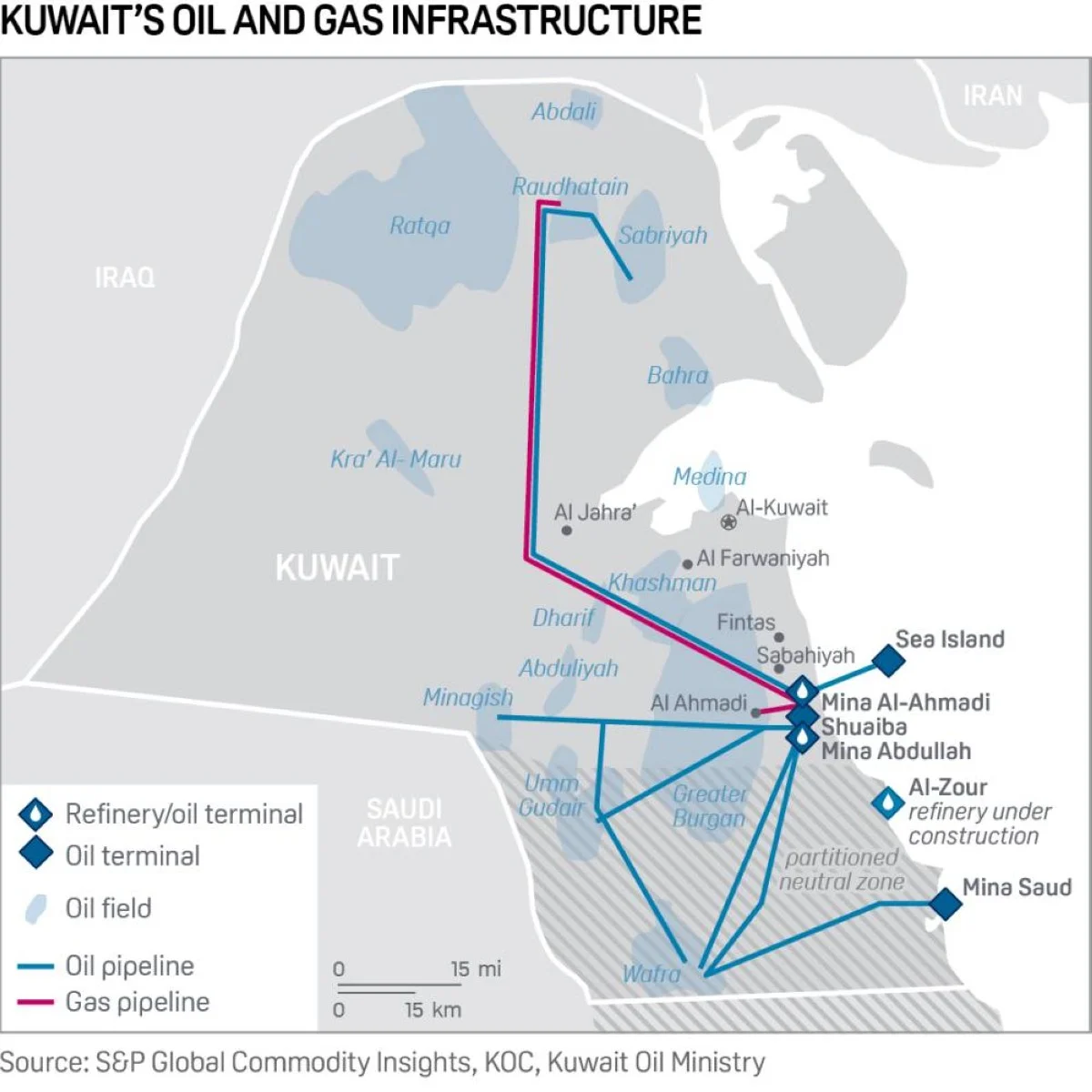

Emad Mohammad Al-Atiqi, a Kuwaiti academic credited with restoring Kuwait University after the Iraqi invasion in the early 1990s and helping mastermind key projects such as the Al-Zour refinery will remain as oil minister under the new government.

“Greater stability in government would clearly be better for the oil ministry which has seen incredible turnover in recent years,’ said Kristin Diwan, senior resident scholar at the Arab Gulf States Institute in Washington.

Production capacity ambitions

Kuwait, the fourth-largest producer in OPEC, is looking to raise its production capacity to 4 million b/d by 2035. Around 3.65 million b/d of production capacity will come from state-owned Kuwait Oil Company’s assets, while 350,000 b/d of capacity will be from the country’s portion of the Neutral Zone shared with Saudi Arabia.

Other Gulf producers such as the UAE and Saudi Arabia have either reached their desired production capacity level or are very close to their target. However, Kuwait, which is the least diversified of all oil producers in the region, is far from its slated goal. Kuwait’s stated production capacity is 2.9 million b/d of hydrocarbons, while output—restrained due to the OPEC+ cuts—was 2.44 million b/d in April, according to the latest Platts survey by Commodity Insights.

The biggest challenge facing Kuwait’s upstream sector is the development of its fast-ageing key asset—the Greater Burgan field. Any addition to production capacity is to largely offset natural decline at the world’s second-largest field. The field is already producing close to capacity – 95 percent of its full potential—sustained by enhancing recovery via gas injection and water flooding.

“Kuwait is targeting 3.2 million b/d by 2025 [of production capacity] and 1.5 million b/d from Greater Burgan, however, some industry sources doubt how realistic this is,” said Chad Barnes, upstream asset valuation analyst at Commodity Insights.

“They previously were aiming for 3.65 million b/d by 2020, which was then pushed back to 2035,” Barnes added. The Greater Burgan field has steadily lost around 18 percent of its production capacity between 2015 and 2021, according to state-owned Kuwait Oil Company. Production capacity of the field, which was estimated at 1.70 million b/d in 2015-16 averaged 1.39 million b/d in 2020-21.

A new era

The expansion of production capacity at Greater Burgan is now more feasible due to the changed political environment, Kamil Al-Harami, an independent energy advisor, said. “Companies such as BP and Shell can now be invited to participate in Kuwait’s upstream sector without any obstacles from Kuwait’s parliament,” he said, adding, Kuwait is also likely to accelerate new oil and gas finds, which would be critical to help achieve its targeted production capacity goals.

The other potential source of capacity additions is the shared Neutral Zone, which restarted output in 2020 after a hiatus of more than four years due to a dispute between the two neighbors. Capacity growth at the field has remained constrained due to operational challenges.

The new government will also have to negotiate with Iran, which disputes Kuwait’s joint claim over the offshore Durra field. Tehran has previously threatened to do exploration work in its share of the field, which it calls Arash. “The government should be more stable now with quicker movement on reforms and projects long stalled in the pipeline in the past,” said Bader Al-Saif, an assistant professor of history at Kuwait University.