Kuwait’s external position remains strong as investment income soars

KUWAIT: Official provisional data show that Kuwait’s external position remained extremely robust in 2023, despite some narrowing of the current account surplus amid reduced oil export revenues.

Investment income receipts were strikingly robust due to the solid performance of overseas financial markets while remittance outflows were pared back, likely due to higher living costs and FX uncertainties in Egypt.

On the flip side, the financial account continued to record sizeable net outflows, albeit lower than in the previous year on reduced outbound investments and a fall in resident deposits abroad. Current account surpluses at a solid level are expected in the medium term due to elevated oil prices, though lower international interest rates from H2 2024 could cut deposit returns, adversely affecting some investment income credits.

The current account surplus narrowed to KD 15.8 billion (31 percent of estimated GDP) from KD 19.3 billion (35 percent of GDP) in 2022. This was the seventh consecutive year of surpluses and the second highest by value in ten years. The decline in 2023 came on the back of a marked reduction in the trade balance due to lower oil export revenues (oil production declined by 4.3 percent and oil prices fell by 20 percent), lower non-oil exports and surging imports (16.8 percent). Oil export revenues constituted around 93 percent of total exports.

As usual, the trade surplus was partially offset by a deficit in the services account, which widened to KD 5.9 billion (11.6 percent of GDP), with growth in credits (+10.8 percent) outpacing growth in debits (+6.8 percent). Driving the increase in services debits was a near doubling of government goods & services purchases and rising transportation debits, as well as an increase in expenditures by residents on tourism.

Investment incomeز

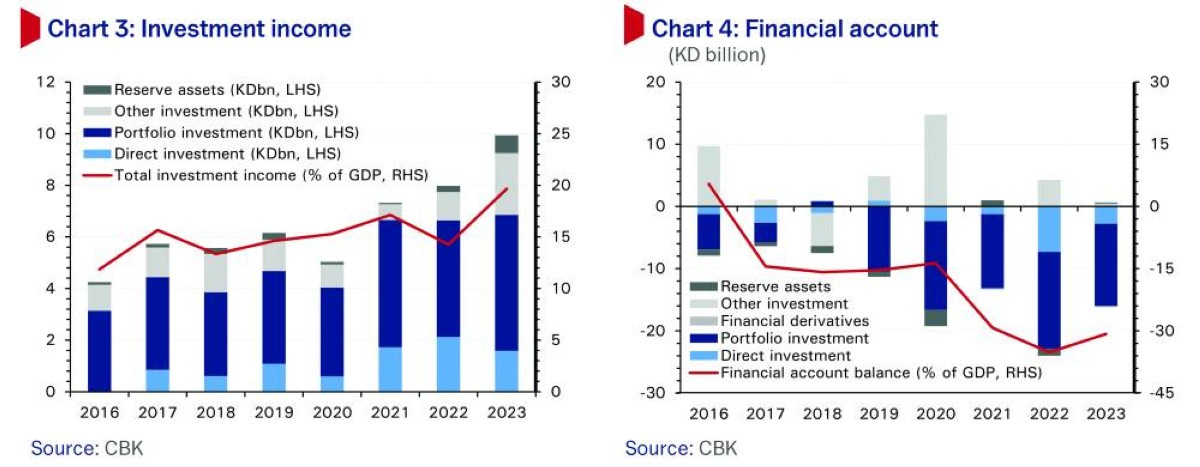

Investment income, which captures income flows from capital deployed overseas, increased by almost 25 percent in 2023 to KD 9.9 billion, the highest annual receipt in the available data. This is on the back of strong financial market performance.

Income from portfolio investments and deposits held overseas surged by 16.5 percent y/y and 87 percent respectively, the latter benefiting from the hike in US policy rates that raised yields on bank deposits and short-term treasuries. Gains were partly offset by a fall in receipts from direct investments abroad (-18.5 percent), though a fall investment income accrued to non-residents from assets in Kuwait (Kuwait’s All-Share Index fell 6.5percent in 2023) also lifted the surplus in the primary income account.

The magnitude of the investment income is significant because it likely consists mostly of returns to the government on its massive investments overseas, managed by the Kuwait Investment Authority. Equivalent to an impressive 19.7 percent of estimated GDP, total investment income is worth around half the revenues the state makes from its net oil receipts and has more than trebled from a decade earlier. Note that this investment income is reinvested by KIA and not included in the government’s headline budget accounts, though easily exceeds the annual fiscal deficits of KD 1-5 billion recorded in recent years with the exception of FY20/21. Workers’ remittances decline amid higher inflation and EGP volatility

The deficit in the secondary income account, however, which predominantly reflects monies transferred overseas by foreign workers in Kuwait, shrank significantly in 2023. Workers’ remittances fell 29 percent to a multi-year low of KD 3.9 billion. This decline likely stemmed from a combination of higher local living costs post-pandemic, a slowdown in expatriate migrant inflows in 2023 (and stronger enforcement of a deportation regime for illegal migrants) and instability in the official and unofficial Egyptian pound exchange rate that likely caused many Egyptian expatriates, the second largest overseas demographic in Kuwait, to pause remitting money back to their country.

Financial outflows down

On the other side of the balance of payments, the financial account recorded net outflows of KD 15.5 billion in 2023 (31 percent of GDP), down from KD 19.7 billion in the previous year. This fall came mainly on a paring back of direct equity investments overseas, which more than halved to KD 3.4 billion from KD 7.8 billion in 2022 as investors looked toward interest gains on local deposits.

Foreign direct investment (FDI) in Kuwait, meanwhile, almost tripled in 2023, rising from KD 232 million in 2022 to KD 649 million. This was the best inward FDI performance in more than ten years, though as a share of output, at 1.3 percent of GDP, the amount was still conservative compared to GCC peers.

Meanwhile, portfolio investment outflows also declined, to KD 13.1 billion (-7.6 percent), mainly due to a drop in outflows into overseas fixed income funds (debt instruments); outflows into foreign equities increased, to almost KD 6.7 billion, in comparison. In ‘other investment’, outflows of residents’ deposits abroad (mainly general government) fell to KD 1.1 billion from KD 2.4 billion in 2022. Finally, gross foreign reserves of the Central Bank of Kuwait declined by KD 150 million (+KD 1.1 billion in 2022). Gross reserves remained large at KD 14.6 billion, covering well above three months of goods & services imports.