Kuwait’s economic activity showed signs of further moderation in 2Q23

KUWAIT: Economic activity showed signs of further moderation in 2Q23 amid the higher interest rate environment, global uncertainties, and oil production cuts.

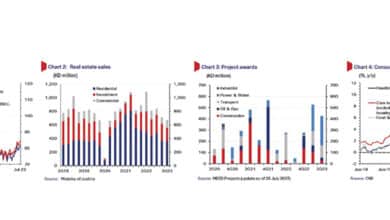

Household and business credit growth remained weak, while real estate sales stayed on a downward trajectory. Oil production also declined during the quarter with the introduction of voluntary output cuts in May to halt sliding oil prices (which showed signs of working as prices rose in July). On a brighter note, although project awards eased in 2Q23, affected by seasonal factors, they remained above 2022 levels, while employment in 1Q23 was still rising at a fairly solid pace.

On the policy front, following the election of a new parliament in June, the new government sent its 2023-27 work plan to the legislature for review. It includes five main pillars covering the economy, jobs, welfare and governance through measures to develop key sectors, boost productivity including in the public sector, address the housing shortage and put the public finances on a sustainable path. Meanwhile, as of mid-July, the government’s expansionary draft budget for FY23/24 was yet to be signed off by parliament. Oil prices pressured Oil prices retreated during 2Q23 amid intensifying global recession concerns.

Tighter global monetary policy to combat inflation, uninspiring Chinese economic metrics and ample crude stock cover amid resilient Russian supply all combined to push market sentiment in a more bearish direction during the quarter. Having traded sideways through June, Brent crude closed the quarter down 6.1 percent q/q to $74.9/bbl (-12.8 percent ytd). Kuwait Export Crude fared better, maintaining a premium over Brent during the quarter, dropping by 1.9 percent q/q to end 2Q23 at $77.8/bbl (-5.1 percent ytd). With prices heading south through 2Q23 and OECD crude stocks not drawing down at the rate expected, oil producers in the OPEC+ group, led by Saudi Arabia, moved to extend the previously announced voluntary production cuts to end-2024.

Saudi went further, with a unilateral, additional cut of 1 mb/d for July, later rolled over into August. For Kuwait, its participation in OPEC+’s additional voluntary production cuts saw its official output reduced by 128 kb/d in May to its quota target of 2.548 mb/d, slightly above the assessment by OPEC secondary sources. Kuwait will need to keep output steady at this level—the lowest since December 2022—through to the end of the year, which poses a challenge for the country’s plan to steadily ramp up crude throughputs in the newly commissioned 1.4 mb/d Al-Zour refinery in pursuit of higher low-Sulphur fuel oil and diesel exports. Kuwait could pare back crude exports in favor of domestic refining and higher refined exports.

Four-year plan to drive growth Following its appointment in June, the government published its proposed work agenda for the coming four years (2023-27) in July, with the aim of kick-starting a more aggressive period of reforms which have lagged versus Kuwait’s GCC peers in recent years. The plan contains five overall pillars: public finance stability, the economic agenda (including diversification away from oil and promoting the role of the private sector), creating job opportunities, sustainable welfare & strong human capital, and productive government. Each pillar contains a number of goals, with a broad timeline relating to each year of the plan.

Key year-one highlights in our view are the targeted passing of the public debt law, the real estate financing law, laws to facilitate the build of large residential cities and distribute 15,000 more plots of residential land, a mass program of road maintenance works, the launch of a plan for economy-wide carbon neutrality by 2060 and measures to boost healthcare capacity. Also eye-catching was the proposal to create a sovereign fund (‘Ciyada’) to invest in the local economy, which could help spearhead key megaprojects and initiatives. A feasibility study on the fund is expected to be completed next year. The government’s program has been sent to the National Assembly for debate and review, and parliament’s response will be monitored for signs of a more cooperative and productive relationship with the government in the upcoming period than previously.

Real estate activity eases Real estate sales dropped to KD 672 million (-38 percent y/y) in 2Q23, their lowest since 3Q20. Residential sales fell by 28 percent on lower transactions (-37 percent), which could be related to the ongoing high valuations within this segment as well as the higher interest rate environment. Investment and commercial segment sales fell by 35 percent and 60 percent, respectively, on rising borrowing costs and perhaps uncertainty about the restructuring of utility pricing. The average transaction value only saw a mild decline, supported by the residential segment, where transactions rose by 14.7 percent y/y. Real estate activity could remain soft throughout this year mainly due to ongoing high residential valuations, tighter financial conditions, elevated construction costs and global macroeconomic uncertainties.

The government’s four-year plan, which includes the distribution of around 43,000 building permits and 15,000 land plots, could help in easing the housing shortage by absorbing incremental demand over the medium term. Though by itself it would not eliminate the large backlog of existing applications estimated at above 90,000 in mid-2023. Projects overseen by the Ministry of Electricity and Water and the Ministry of Public Works accounted for the bulk of awards signed off on in the quarter. Despite the slower 2Q23, compared to the previous quarter, the market appears to be improving, albeit from a low base. MEED Projects expects KD 5.2 billion worth of contracts will be awarded this year, though half this figure relates to KIPIC’s Al-Zour Petrochemicals project packages (1&2) (KD 2.4 billion).

The outlook remains heavily influenced by events in the political sphere, and in particular cooperation between government and parliament in executing the development plan. Employment grows According to the latest data from the Labor Market Information System (LMIS) and Central Bureau of Statistics (CSB), total employment continued to recover in 1Q23 from its trough seen at the end of 2021, increasing by 10 percent y/y due to the influx of foreign workers following the resumption of economic activities post-pandemic. The number of expatriate workers (excluding domestic workers) rose by 12.3 percent y/y in 1Q23, while growth among Kuwaiti nationals eased to 2.3 percent.

Jobs gains among Kuwaitis were driven by the public sector, which saw a net addition of 11K jobs, while private sector jobs fell by 1,000 over the last four quarters. Expatriate employment was boosted by gains in the private sector (+173K y/y), mainly low paid workers in labor-intensive sectors such as construction (+121K) and manufacturing (+26K). Meanwhile, domestic workers also recorded a sharp rise of 27 percent y/y (+167K). Inflation edges up Consumer price inflation rose to 3.8 percent y/y in June, up slightly from 3.7 percent in March and 3.3 percent at the beginning of the year. Prices in the “housing services” category (+3.2 percent y/y in June) have risen, largely reflecting a pickup in rents, while inflation in clothing and miscellaneous sub-segments continued to trend upwards.

Nevertheless, price growth in food and beverages, the second largest component by weight, eased to its lowest rate this year in June (6.3 percent y/y) amid softening global food prices. Meanwhile, the core inflation rate, which excludes food and housing, has also moved up versus the start of the year, but remained lower than the headline rate at 3.3 percent y/y in June. With consumer and credit activity softening against a backdrop of tighter monetary policy (relative to last year), inflationary pressures will likely ease as we progress through the year. Nevertheless, since it has come in slightly higher than expected so far this year, we now see year-average inflation at 3.4 percent versus the previous 3.1 percent.

Domestic credit growth continues to soften as the mid-point of the year approaches. Growth was essentially flat over the first five months of 2023, with May’s reading of 2.7 percent y/y significantly down on the double-digit growth recorded a year earlier. Higher interest rates, banks’ lower price competition in terms of retail lending and normalizing growth following a very strong 2022 are some of the factors behind this year’s weaker readings. Business credit increased by just 1.1 percent in the year to May, cutting the annual growth rate to 2.1 percent. This relatively muted business credit growth is partly due to weakness in the particularly interest rate-sensitive real estate sector and in the oil/gas sector, which are both down year-to-date.

Excluding these two sectors, business credit would have expanded by a relatively decent 2.9 percent ytd and 7.0 percent y/y. In fact, several sectors, such as ‘construction’ and ‘other services’ have been resilient so far this year, posting ytd growth of 4.5 percent and 3.8 percent, respectively. The slowdown is even sharper in household credit, which is broadly flat year-to-date, cutting the y/y increase to 5.3 percent in May. Overall, such subdued growth does not bode well for the remainder of the year, knowing that the second half of the year has historically been weaker than the first. Resident deposit growth has been stronger than credit growth, increasing by 3.2 percent in the year to May (+3.0 percent y/y).

Growth over the past year has been driven by both private sector (+6 percent) and government deposits (+10 percent), in contrast to deposits from public institutions, which fell by 15 percent y/y in May. Within private-sector KD deposits, current and saving accounts (CASA) continued to decrease (-11.8 percent y/y) while time deposits remained on an upward trend (+26 percent), which is unsurprising given the higher interest rate environment. The Central Bank of Kuwait has hiked the discount rate by a cumulative 2.5 percent since March 2022, half of the 5 percent implemented by the US Fed. However, the Fed is close to ending its rate hiking cycle, with the futures market currently expecting a final 25 bps hike on 26July.

Equities pare losses Kuwaiti equities ended a lackluster 2Q23 little changed (-0.3 percent q/q), with May’s steep banking sector losses (-6.0 percent m/m) partially recouped in June after the Fed’s rate hike pause eased investor concerns. Sentiment was also helped by less political uncertainty given the conclusion of the parliamentary elections and signs of improvement in global and regional economic data. Market capitalization subsequently recovered to KD 45.7 billion as of end-June from an 8-month low of KD 43.7 billion in May, while turnover by value eased to a monthly average of KD 798 million reflecting lower trading activity and prices. Despite the recent pickup, the market is still far from a full recovery given that the market capitalization and index level are well below their November 2022 peaks.