Investors flock to Aramco share sale that could raise $13bn

DUBAI: The next CEO of Boeing should have an understanding of what led to its current crisis and be prepared to look outside for examples of best industrial practices, the head of the International Air Transport Association said on Sunday.

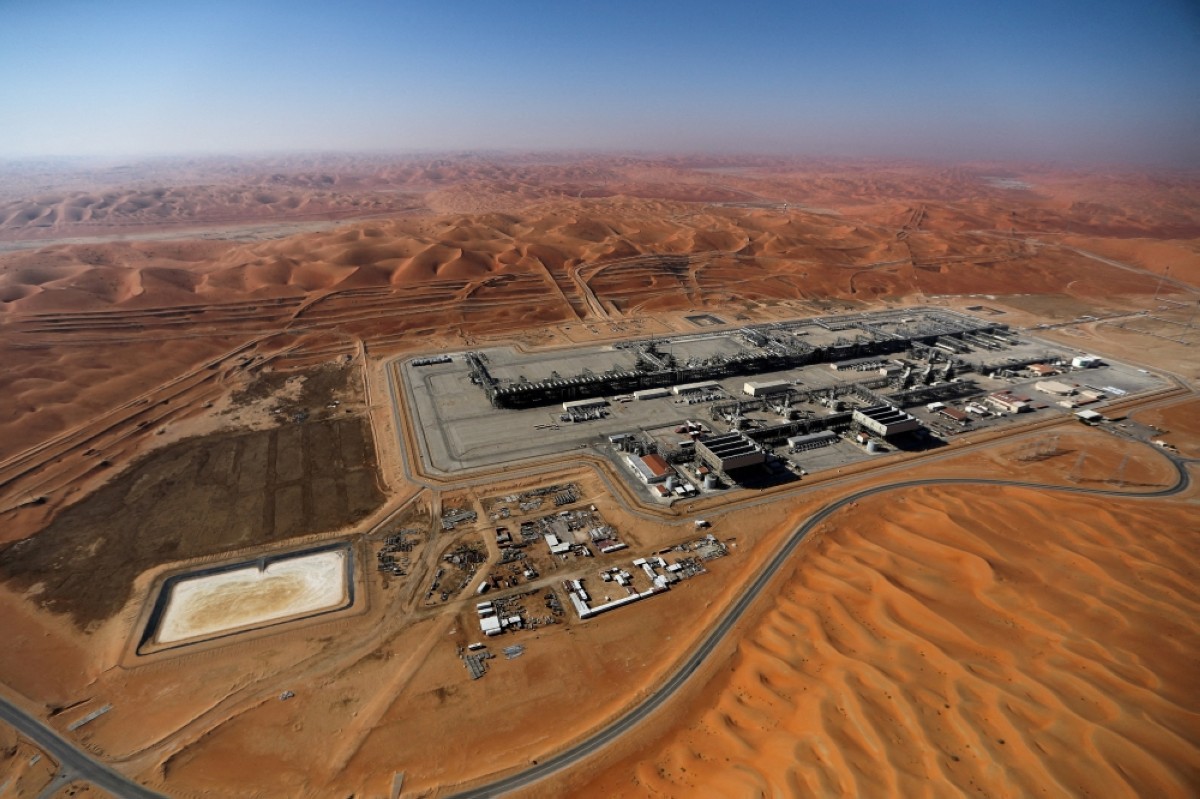

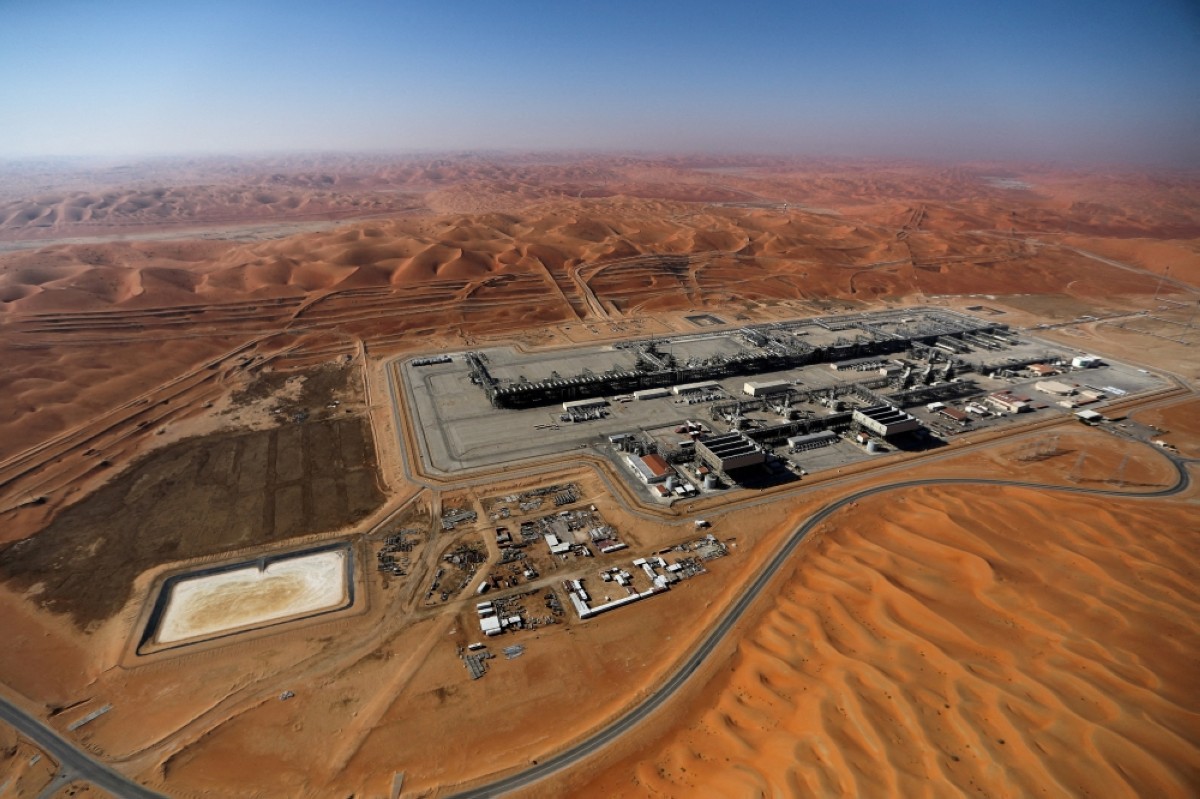

General view of Aramco's oil field in the Empty Quarter, Shaybah, Saudi Arabia.-- Reuters.

US planemaker Boeing is engulfed in a sprawling safety crisis, exacerbated by a January mid-air panel blowout on a near new 737 MAX plane. CEO Dave Calhoun is due to leave the company by the end of the year as part of a broader management shake-up, but Boeing has not yet named a replacement.

“It is not for me to say who should be running Boeing. But I think an understanding of what went wrong in the past, that’s very important,” IATA Director General Willie Walsh told Reuters TV at an airlines conference in Dubai, adding that Boeing was taking the right steps. IATA represents more than 300 airlines or around 80 percent of global traffic. “Our industry benefits from learning from mistakes, and sharing that learning with everybody,” he said, adding that this process should include “an acknowledgement of what went wrong, looking at best practice, looking at what others do”.

He said it was critical that the industry has a culture “where people feel secure in putting their hands up and saying things aren’t working the way they should do”. Boeing is facing investigations by US regulators, possible prosecution for past actions and slumping production of its strongest-selling jet, the 737 MAX.

Calhoun, a Boeing board member since 2009 and former GE executive, was brought in as CEO in 2020 to help turn the planemaker around following two fatal crashes involving the MAX, its strongest-selling jet. But the planemaker has lost market share to competitor Airbus, with its stock losing nearly 32 percent of its value this year as MAX production plummeted this spring.

“The industry is frustrated by the problems as a result of the issues that Boeing have encountered. But personally, I’m pleased to see that they are taking the right steps,” Walsh said. Delays in the delivery of new jets from both Boeing and Airbus are part of wider problems in the aerospace supply chain and aircraft maintenance industry complicating airline growth plans. Walsh said supply chain problems are not easing as fast as airlines want and could last into 2025 or 2026.

“It’s probably a positive that it’s not getting worse, but I think it’s going to be a feature of the industry for a couple of years to come,” he said. Earlier this year IATA brought together a number of airlines and manufacturers to discuss ways to ease the situation, Walsh said. “We’re trying to ensure that there’s an open dialogue and honesty,” between them, he said.

DUBAI: Saudi Arabia’s sale of shares in oil giant Aramco drew more demand than the stock on offer within hours of kicking off on Sunday, a landmark deal that could raise up to $13.1 billion in a major test of international appetite for the kingdom’s assets. The banks on the deal will take institutional orders through Thursday and will price the shares the following day, with trading expected to start next Sunday on Riyadh’s Saudi Exchange.

The offering will be a gauge of Riyadh’s appeal to foreign investors, a key plank of the kingdom’s ambitious plan to overhaul its economy. Foreign direct investment has repeatedly missed its targets. The sale will also bolster efforts by the government to wean itself off its “oil addiction”, as Saudi Crown Prince Mohammed bin Salman once called it, analysts and sources have said.

The sovereign wealth fund, the Public Investment Fund (PIF), the preferred vehicle driving the mammoth agenda that has poured tens of billions of dollars into everything from sports to futuristic desert cities, is likely to be a beneficiary of the funds, they said.

Aramco’s shares were down 2.6 percent on Sunday to 28.25 riyals ($7.53) as of 0825 GMT. Saudi Arabia is offering investors about 1.545 billion Aramco shares, or 0.64 percent, at 26.7 to 29 riyals, or just under $12 billion at the top end of the range. “Books are covered on the full deal size within the price range,” meaning indicated demand exceeded deal size, one of the banks on the deal said.

The banks can increase the offering by a further roughly $1 billion. If all the shares are sold, the Saudi government will be cutting its stake in the world’s top oil exporter by 0.7 percent.

The world’s top investment banks are helping to manage the sale - Citi, Goldman Sachs, HSBC, JPMorgan, Bank of America and Morgan Stanley - along with local firms Saudi National Bank, Al Rajhi Capital, Riyad Capital and Saudi Fransi. M Klein and Company and Moelis are independent financial advisers for the deal.

UBS Group’s Credit Suisse Saudi Arabia unit alongside BNP Paribas, Bank of China International and China International Capital Corporation are also helping to seek buyers for the shares, according to a stock exchange filing on Sunday. About 10 percent of the new offering will be reserved for retail investors, subject to demand.

The deal kicks off as the OPEC+ group of oil producers is set to meet on Sunday to determine output policy, with some ministers meeting in Riyadh, according to OPEC+ sources. The de facto Saudi-led Organization of the Petroleum Exporting Countries and allies led by Russia, together known as OPEC+, is currently cutting output by a total of 5.86 million barrels per day (mbpd), equal to about 5.7 percent of global demand.

Still, Aramco - long a cash cow for the Saudi state - has boosted its dividends, introducing a new performance-linked payout mechanism last year, despite lower profits as a result of the lower volumes. Saudi Arabia is producing about 9 mbpd of crude, roughly 75 percent of its maximum capacity. The Saudi government directly holds just over 82 percent of Aramco. PIF owns 16 percent - 12 percent directly and 4 percent through subsidiary Sanabil, with the remainder held by public investors. — Reuters.