IMF: Energy transition at risk from commodity market fragmentation

WASHINGTON: Growing geopolitical fragmentation since the invasion of Ukraine has hit commodity markets, threatening to slow the transition to renewable energy as the world looks to combat climate change, the International Monetary Fund said Tuesday.

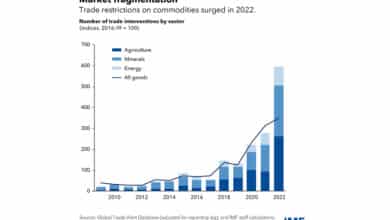

The fractures have led to a doubling in new trade restrictions on commodities since 2021, with low-income countries bearing the brunt of the costs, the IMF announced Tuesday.

“To achieve net-zero-carbon emission targets, demand for minerals is set to rise several-fold in the coming years,” IMF economists Jorge Alvarez, Mehdi Benatiya Andaloussi and Martin Stuermer wrote in a blog post accompanying a chapter from the fund’s upcoming World Economic Outlook (WEO) report. But they warned that economically viable deposits are concentrated in just a few countries, and that “fragmented markets could complicate matters.”

“Commodities, particularly minerals critical for the green transition and some highly traded agricultural goods, are especially vulnerable in the event of more severe geoeconomic fragmentation,” they said. The IMF’s flagship report on the world’s economy will be published in full next week at the fund and the World Bank’s annual meetings, which take place this year in the Moroccan city of Marrakesh.

Commodity market ‘turmoil’

The IMF said further geopolitical fragmentation could lead to “turmoil” in the commodity markets, causing long-term economic losses of around 0.3 percent of global economic outlook. Losses in low-income and vulnerable countries would be even higher, reaching around 1.2 percent of gross domestic product, on average. The impact largely stems “from disruptions in agricultural imports,” IMF economists said. “This would exacerbate food security concerns, as low-income countries are particularly reliant on food imports to feed their population,” they wrote.

The IMF economists estimated that severe trade disruptions could lower investment in renewable energy and electric vehicles by as much as 30 percent by the year 2030, leading to “slower mitigation of climate change.” The IMF called for greater cooperation to negate the risks of commodity market fragmentation on the energy transition. “If full cooperation remains elusive, pragmatic solutions must be explored to tackle the most pressing challenges: mitigating the risk of food insecurity and supporting the green energy transition,” they said.

They called for “urgent efforts” to be made to ensure “the unhindered flow of food and minimize the threat of food insecurity in low-income countries.” They also called for multilateral efforts to establish a “green corridor,” to maintain the flow of critical minerals. “This would help avert climate change,” they added. These adverse effects are partly due to highly concentrated commodity production, largely a consequence of regional advantages in natural resource endowments. The three largest suppliers of minerals, for example, account for about 70 percent of global mined production on average.

Scaling up mining and processing capacity can take years, resulting in slow responses to price signals. At the same time, some commodities like food and energy play a pivotal role in household consumption, while many minerals are key inputs for vital technologies and manufacturing. This combination of concentrated supply and widespread demand leads to extensive commodity trading, with many countries relying heavily on imports from only a handful of suppliers. This makes commodities more vulnerable in the event of trade restrictions, the report said.

Our research indicates that fragmentation of global commodity markets into two hypothetical geopolitical blocs, based on the March 2022 United Nations General Assembly vote demanding Russia end its war on Ukraine, could lead to significant price swings. It could also cause wide price differentials across blocs, particularly of minerals critical to the green transition and highly traded agricultural goods. Prices would also be more volatile in a fragmented world. Fragmented markets would offer fewer buffers to absorb future commodity shocks, such as poor harvests or extreme weather. Moreover, even a single commodity producer switching its geopolitical allegiance could trigger significant price fluctuations.—AFP.