Global economy grows at 3%, lacks dynamism: IMF

WASHINGTON: The global economy is growing faster compared to the difficult pandemic period when global output contracted and slowly recovered thereafter although it still lacks dynamism, the International Monetary Fund (IMF) in a report.

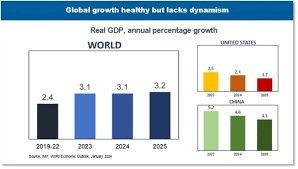

“At around 3 percent, global growth is well below the historical average of 3.8 percent, which was recorded during 2000 to 2019 and, hence, provides little positive spillovers to Europe. We expect the US economy to slow as its post-pandemic recovery runs its course”, it said. Similarly, activity in China is cooling as weaknesses in the property sector are expected to persist.

For Europe, after suffering an exceptionally large energy price shock in 2022, the IMF projects a gradual recovery. “Compared to dire predictions of a recession at that time, this outcome would be a remarkable accomplishment,” the report said.

The IMF expects growth in the euro area overall to rise from below 1 percent this year to 1.7 percent in 2025. In the CESEE region, it expects the economies to grow close to 3 percent this year and 3.5 percent next year. “Our forecast constitutes what has been called a “soft landing.” By this we mean that the decline of inflation in 2024-25 to previous levels is accompanied by only a mild growth slowdown. The fact that the economic costs of the energy price shock and higher interest rates—which have been raised to slow down price increases—have so far been mild is quite remarkable,” it said.

The disinflation

According to the IMF, core inflation, a measure of underlying price dynamics which excludes volatile food and energy price components, is higher in emerging European economies than in advanced European economies. In both country groupings, core inflation is coming down only slowly.

The decline of the inflation rate is progressing more slowly in Romania, Moldova, Montenegro, Hungary, and Serbia than elsewhere in the CESEE region. One important factor especially in emerging European economies is that labor markets need to cool at just the right pace.

Overall, given current levels of inflation and price and wage dynamics, our forecast suggests that achieving price stability targets will take one year longer in the CESEE region compared to advanced European economies. In general, the underlying inflationary pressures in the region remain stronger than in advanced economies. Many central banks in the region should therefore maintain a tight monetary stance for longer than for example the ECB.

Achieving a soft landing will not be easy, but it is critical, also because it will help policymakers getting ready for what will be an even more difficult task ahead: raising CESEE’s growth prospects in a durable manner. Growth prospects in advanced and emerging European economies have dimmed.

Technology

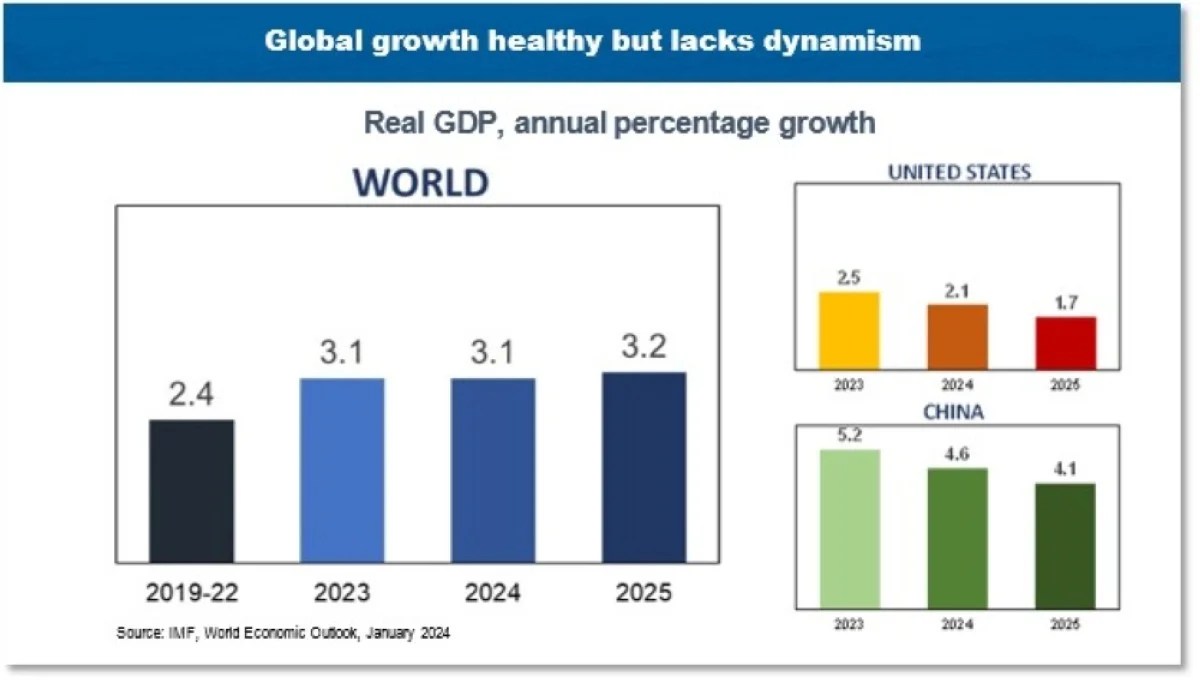

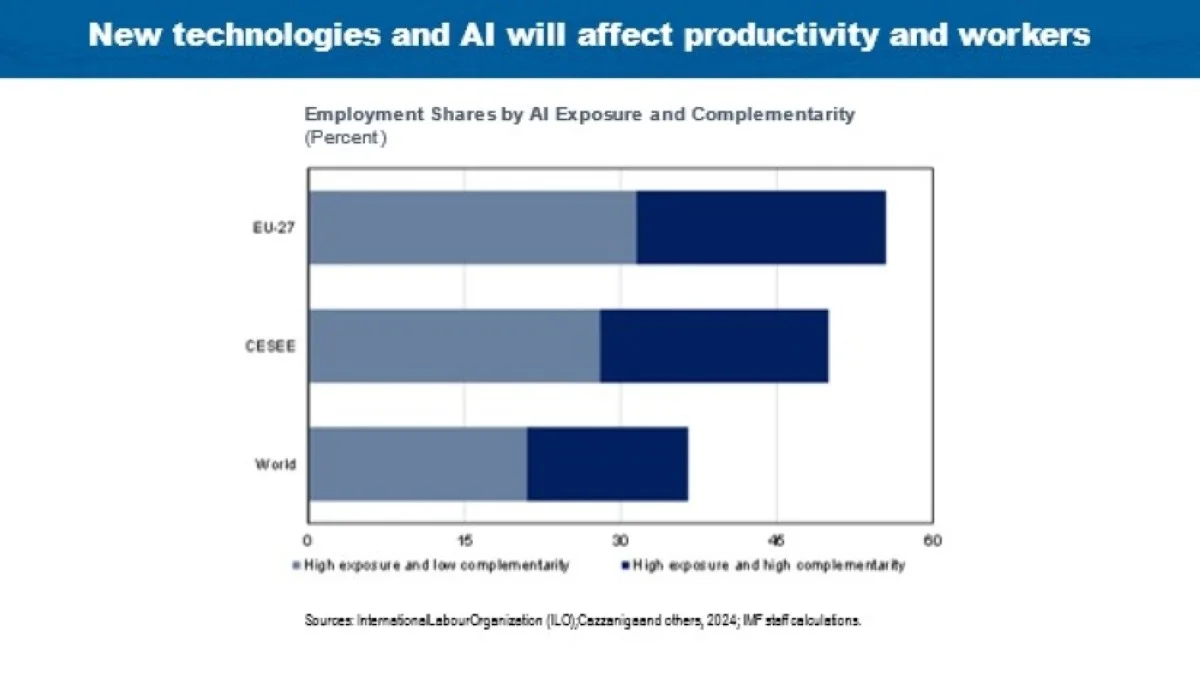

Another area that deserves the attention of policymakers is the promise of growth from technological progress. The advances of artificial intelligence are captivating the world. Its applications could jumpstart productivity, boost global growth, and raise incomes around the world. Yet, AI could also replace jobs and deepen inequality, it mentioned in the report.

“And at this stage, it is difficult to foresee the economic effects, as AI will ripple through economies in complex ways. Nonetheless, we can and should start assessing which types of occupations AI will likely affect; which activities it will complement, and which ones it may replace,” it said.

Recent work by the IMF shows that close to 60 percent of all workers in the EU will likely be affected by AI in one way or another. For the CESEE region, the share is close to 50 percent.

Among those affected, for about half of the AI will complement their work and raise their productivity. For the other half, AI will be less complementary and replace some tasks or activities. In most scenarios, AI will likely worsen overall inequality.

It will be more advantageous to the higher-skilled and reduce the need for medium and low-skilled workers alike. This is a troubling prospect that policymakers should assess and respond to as needed.

The availability of social safety nets and retraining programs mentioned earlier are of even more importance from this perspective. They will help make the AI transition more inclusive and curb inequality, the report added.