EU updates tax havens blacklist

BRUSSELS, Oct 17 (KUNA) -- EU Economic and Financial affairs Council added Tuesday Antigua and Barbuda, Belize and Seychelles to the EU blacklist of tax havens saying all three jurisdictions were found to be lacking with regard to the exchange of tax information on request.

The Council, which is meeting in Luxembourg today said in a statement it removed British Virgin Islands, Costa Rica and Marshall Islands from the list saying they have reformed their tax administration and agreed to good tax governance.

With these updates, the EU blacklist consists of the following 16 jurisdictions: American Samoa, Antigua and Barbuda, Anguilla, Bahamas, Belize, Fiji, Guam, Palau, Panama, Russia, Samoa, Seychelles, Trinidad and Tobago, Turks and Caicos Islands, and US Virgin Island and Vanuatu.

The Council said it regrets that these jurisdictions are not yet cooperative on tax matters and invites them to improve their legal framework in order to resolve the identified issues.

In addition to the list of non-cooperative tax jurisdictions, the Council approved the usual state of play document (Annex II) which reflects the ongoing EU cooperation with its international partners and the commitments of these countries to reform their legislation to adhere to agreed tax good governance standards Four jurisdictions were removed from the state of play document (Annex II). Jordan and Qatar fulfilled their commitments by amending a harmful tax regime. Montserrat and Thailand fulfilled all their pending commitments related to country-by-country reporting of taxes paid, said the statement.

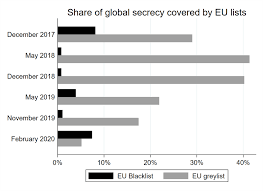

The EU blacklist of tax havens was established in December 2017. It is part of the EU's external strategy on taxation and aims to contribute to ongoing efforts to promote tax good governance worldwide.

Jurisdictions are assessed on the basis of a set of criteria laid down by the Council. These criteria cover tax transparency, fair taxation and implementation of international standards designed to prevent tax base erosion and profit shifting.

Meanwhile, the international aid and charity organization Oxfam criticized the new blacklist as "a nonsense exercise." Chiara Putaturo, Oxfam EU tax expert, in a statement said "For how much longer will the EU persist in this nonsense exercise? The list is toothless. It leaves off the hook zero tax countries like the British Virgin Islands and fails to screen countries like the US and the UK along with EU tax havens like Luxembourg and Malta. " "It's an insult to ordinary people struggling with soaring bills while the super-rich and profit-hungry multinationals get a free pass to escape their tax obligations," added the statement. (end) nk.aa.